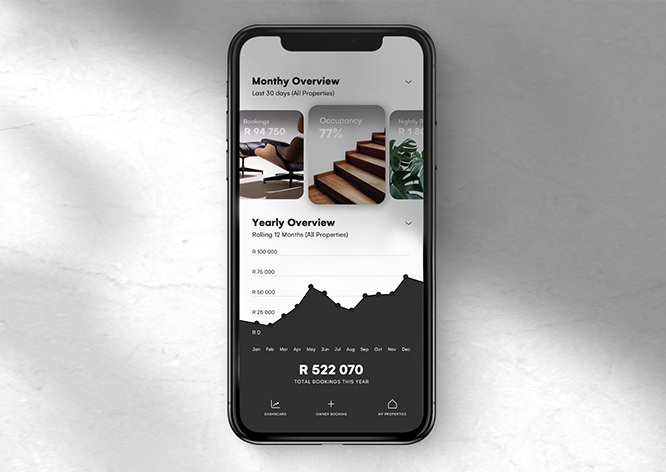

Income Generation

The right short-term rental property has the ability to consistently outperform the long-term rental rate on a net basis. Carefully selected properties have the ability to cover their full cost from Day 1.

Capital Appreciation

Well-managed short-term rentals can typically achieve a higher capital appreciation over time since it can be sold as a going concern and is always kept in a showroom condition. Long-term rentals often degrade over time and require significant upgrades after long tenancies.

Flexible Personal Use

One of the best things about owning an Airbnb is that you can use it yourself whenever you like. That said, if you do think of your property primarily as an investment, you’ll want to minimize personal use (or save it for the shoulder/winter season) and prioritize guest access.

Hands-off Ownership

The best short-term rental management companies make it possible to own a property that takes care of itself. Whether you’re in another city or just don’t want to deal with the hassle, it is one of the great joys of property ownership to know that your asset is looked after and generating income.

Tax Benefits

Running your investment or vacation rental property as a business allows you to deduct expenses related to rates/levies, operating expenses, insurance and bond repayments. Some properties are also located in UDZ areas which allow further tax write offs. Consulting an accountant or tax practitioner prior to purchasing a property is generally a good idea

Recession-resistant

The short-term rental industry has been remarkably resistant to economic shocks over the past decade, especially for properties in great locations. Even Covid has shown us how quickly travel returned regionally and then subsequently bounced back to pre-pandemic highs. More than half of all hospitality consumers would now choose a self-catering property over a hotel room.